All Categories

Featured

Table of Contents

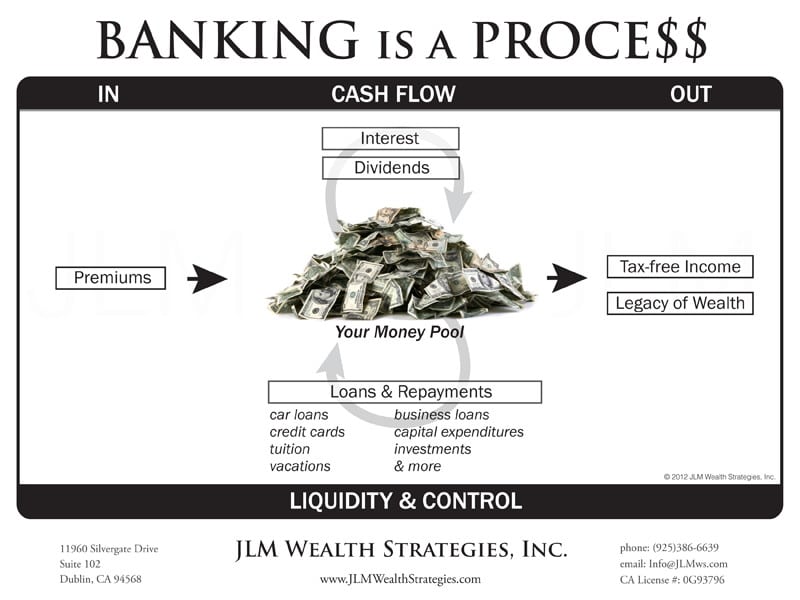

Picture having actually that interest come back to in a tax-favorable account control. What chances could you capitalize on in your life with also half of that cash money back? The basic idea behind the Infinite Banking Concept, or IBC, is for individuals to take even more control over the funding and banking features in their everyday lives.

By having your dollar do even more than one work. Currently, when you spend $1, it does one point for you. Possibly it pays a bill.

What if there was a strategy that educates people just how they can have their $1 do than one job just by moving it via a possession that they control? This is the essence of the Infinite Banking Idea, initially championed by Nelson Nash in his book Becoming Your Own Lender.

In his book he shows that by developing your very own personal "financial system" through a specially designed life insurance coverage agreement, and running your dollars via this system, you can considerably improve your monetary scenario. At its core, the principle is as basic as that. Creating your IBC system can be performed in a range of innovative means without altering your capital.

This is component of the process. It requires time to expand a system to take care of everything we desire it to do. Believing long term is critical. Just bear in mind that you will be in monetary scenario 10, 20 or perhaps thirty years from now. To obtain there we have to start somewhere.

The payments that would have otherwise gone to a financial institution are paid back to your personal pool that would have been utilized. More cash goes into your system, and each buck is performing several work.

Your Own Bank

This money can be made use of tax-free. You have complete accessibility to your funds whenever and for whatever you want, without costs, penalties, evaluation boards, or extra collateral. The money you make use of can be repaid at your leisure without collection settlement timetable. And, when the moment comes, you can hand down everything you've accumulated to those you like and appreciate entirely.

This is exactly how family members hand down systems of riches that make it possible for the future generation to follow their dreams, start companies, and take benefit of possibilities without losing it all to estate and inheritance taxes. Companies and financial establishments use this technique to create working pools of funding for their services.

Walt Disney used this strategy to start his dream of building a motif park for kids. We would certainly love to share much more instances. The concern is, what do desire? Assurance? Financial security? A sound monetary service that doesn't depend on a fluctuating market? To have cash money for emergencies and opportunities? To have something to pass on to individuals you love? Are you happy to discover more? Financial Preparation Has Failed.

Join among our webinars, or go to an IBC bootcamp, all complimentary of cost. At no charge to you, we will certainly show you extra regarding exactly how IBC functions, and create with you a plan that works to address your problem. There is no obligation at any type of point while doing so.

Infinite Banking Concept Canada

This is life. This is legacy.

We have actually been assisting families, company owners, and people take control of their financial resources for several years (life insurance concept). Today, we're excited to revisit the fundamental concepts of the Infinite Financial Concept. Whether you're taking care of personal financial resources, running an organization, or preparing for the future, this idea offers an effective tool to accomplish financial objectives

An usual mistaken belief is that limitless banking revolves around buying life insurance, but it's actually regarding controlling the process of financing in your life. Nelson Nash, in his publication Becoming Your Own Lender, makes this clear. The core idea is that we fund every little thing we buyeither by borrowing cash and paying interest to another person, or by paying money and losing on the interest we could have gained somewhere else.

Some might declare they have an "limitless financial policy," yet that's a misnomer. While specific policies are created to apply the Infinite Financial Concept, Nelson discovered this procedure using a standard entire life insurance plan he had purchased back in 1958.

Nelson received a declaration for his State Ranch life insurance policy. He noticed that for a $389 premium, the cash value of the policy would certainly increase by nearly $1,600.

This would ensure that when mortgage prices spiked, the boost in money worth would certainly aid cover the additional cost. This understanding marked the genesis of the Infinite Banking Idea. It's a story that reverberates to this day. Numerous people continue to be at the mercy of fluctuating rate of interest prices on home loans, home equity lines of credit score, or service loans.

Royal Bank Avion Infinite

Nelson acquired his policy for its fatality benefit. Over time, the cash worth expanded, developing an economic resource he could tap right into through policy finances. His background as a forester offered him an unique long-term viewpoint; he thought in terms of years and generations.

Significantly, this was not a temporary remedy. Nelson was buying a plan that wouldn't have cash money value for 2 or three years. However his long-term thinking paid offit actually conserved him. This brings us to the essence of the Infinite Financial Concept: it has to do with exactly how you use your money.

With your very own pool of cash, the possibilities are unlimited. There's a crucial action: playing the straightforward lender. This suggests valuing your money the exact same means a financial institution worths theirs. Whether you're obtaining from your policy or settling it, treat it as if you were dealing with a conventional loan provider.

When financial institution car loans were at 2-3%, some selected not to obtain against their plans. As financial institution prices climbed up to 8-10% while plan lendings stayed at 5%, those with insight and a well-structured plan appreciated the freedom to obtain on extra favorable terms.

Significantly, unlimited banking does not call for way of life sacrifices. It's regarding making smarter selections with the cash you currently spend.

At its core, infinite banking allows one to take advantage of one's cash value inside their entire life insurance policy policy as opposed to counting on standard funding from financial institutions or other financial institutions. It does this by utilizing the person's insurance coverage and its comparable cash worth as collateral for the loan. "Insurance," in this situation, usually describes, which covers a person's entire life (unlike, which only covers the insurance policy holder's beneficiaries in the event of death).

Whole Life Concept

Insurers normally refine such requests without problem since the collateral is currently in their hands. They can easily take ownership of it if the policyholder defaults on their settlements. Best of all, the system provides big tax obligation financial savings considering that returns from cash-value life insurance policy plans are exempt to earnings tax.

Latest Posts

Being Your Own Bank

Infinite Banking Center

Infinite Banking: Using Life Insurance As A Source Of Liquidity